by Shaun Chamberlin | May 17, 2012 | All Posts, Cultural stories, David Fleming, Economics, Favourite posts, Politics, The Transition Timeline, Transition Movement

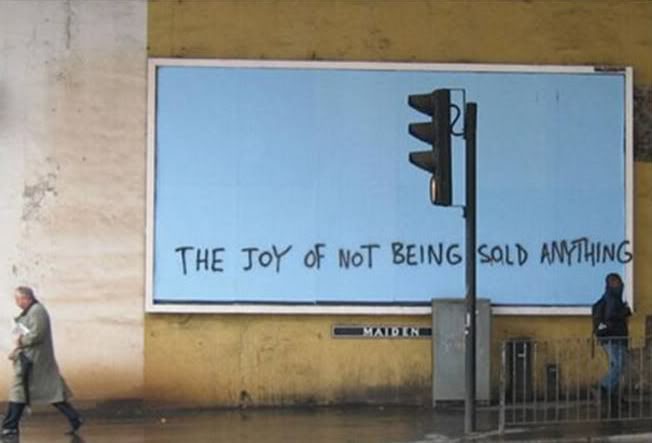

Last month I was one of forty or so attendees of the Transition ‘Peak Money’ day. It was a fascinating collection of people, from theorists to activists, and a potent opportunity to reflect on the challenges facing us all as the glaring errors at the heart...

by Shaun Chamberlin | Jan 23, 2011 | All Posts, Climate Change, Cultural stories, Economics, Peak Oil, Politics, Reviews and recommendations, TEQs (Tradable Energy Quotas), Transition Movement

What a week – Tuesday’s launch of the All Party Parliamentary Group on Peak Oil’s report into TEQs was a tremendous success, with excellent media coverage, including Time magazine, The Sunday Times, Bloomberg News, the BBC, the Financial Times and...

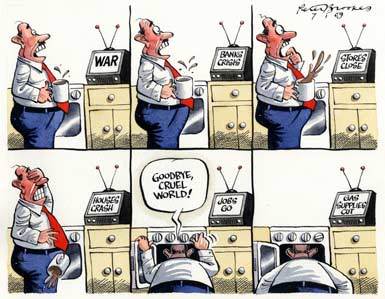

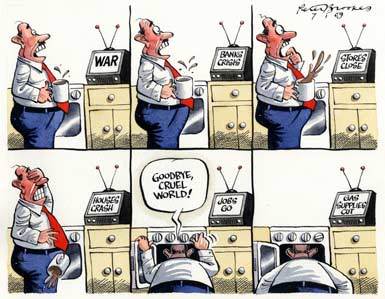

by Shaun Chamberlin | Jun 15, 2010 | All Posts, Economics, Favourite posts, Peak Oil, Transition Movement

This post was originally written by me as a guest post for Rob Hopkins’ Transition Culture blog, but I have kindly given myself permission to reproduce it here 😉 So here I am. I fully intended to be giving the England match my full attention right now, but...

by Shaun Chamberlin | Jun 9, 2010 | All Posts, Climate Change, Cultural stories, Favourite posts, Peak Oil, TEQs (Tradable Energy Quotas), The Transition Timeline, Transition Movement

https://www.darkoptimism.org/wp-content/uploads/2020/10/10-03-26-Radio-EcoShock_Chamberlin_LoFi.mp3 Christopher Fraser of London Transition has kindly transcribed the above popular interview with Canada’s Radio Ecoshock that I posted a couple of months back....

by Shaun Chamberlin | Mar 28, 2010 | All Posts, Climate Change, Cultural stories, Peak Oil, TEQs (Tradable Energy Quotas), The Transition Timeline, Transition Movement

https://www.darkoptimism.org/wp-content/uploads/2020/10/10-03-26-Radio-EcoShock_Chamberlin_LoFi.mp3 Above is a 24 minute interview I did last week with Canada’s excellent Radio Ecoshock. The full 60 minute show can be heard here. Dark Optimism readers may also...

Recent Comments