The key theme that seemed to run throughout the day, then, was ‘collapse’. Sadly, I was an hour late to the event, but the first sessions I witnessed were reports from Transitioners in Portugal, Ireland and Greece on the ‘front line’ impacts of the economic crunch. The talk was of collapse having already happened for many families and communities there, with statistics quoted including an 89% increase in Greek unemployment in three years, and Irish suicides having doubled since 2007.

They pulled no punches. Most of us were left grey and shaken as the harsh realities of the crisis were relayed. For me, a defining memory of the day was watching the alternative economists listening to this — people who have spent decades warning of these outcomes and trying to head them off — their heads shaking sadly with lips pursed, hands involuntarily coming to their faces in dismay as their Cassandra curse unfolds. Of course, the statistics were not new to them, but hearing these stories in person somehow always brings a heavier human impact. Watching that impact reflected in their expressions felt almost inappropriate, yet doubly powerful.

The disconnect was palpable.

Could we really feel that the Transition movement’s responses were adequate in the face of the suffering being inflicted by the crisis? Would speaking of local currencies feel sufficient in comforting the family of the pensioner who shot himself in front of the Greek Parliament last month after his pension was cut to nothing (described by Greeks not as suicide, but as ‘financial murder’)?

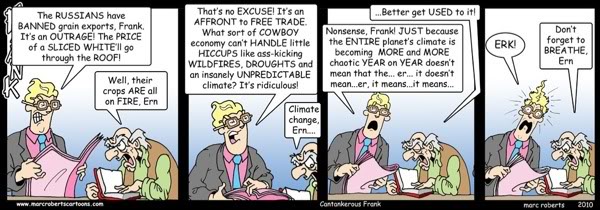

Over lunch I discussed this with Peter Lipman, Chair of the Transition Network. He pointed out that much the same could be asked of Transition responses to peak oil and climate change — would a local energy project, say, match up to the devastation felt by a Bangladeshi flooded out of their homeland?

Yet, on reflection, there does seem to be something different about the crisis of the financial economy — it isn’t as directly rooted in physical reality. There is something immutable about the amount of fossil fuel available to the world, and overwhelming physical inertia in the inexorably increasing levels of greenhouse gases in our atmosphere.

The economic crisis, on the other hand, seems to be perhaps more wholly a crisis of narrative. It is primarily cultural inertia and entrenched sociopolitical influence that prevents us from rapidly changing the course of events, not hard physics.

This makes it a particularly exciting area for Transition to engage with, alongside the likes of Occupy, UK Uncut etc. For all the vested interests and political power around our current economic system, it seems at least theoretically possible that popular movements could actually change the fundaments of this crisis with speed.

Yet personally, when writing The Transition Timeline, economics was probably the section I found most difficult. How to even get to grips with a topic where no-one seems able to agree on even the basics — where, for example, some argue that difficult times call for belt-tightening, while others advise greater spending..?

It was the late David Fleming who helped me find bedrock, explaining that underneath all the jargon and mystery, economics is fundamentally the discussion of who should work at what and for how long, and of how society’s resources should be distributed. He also noted that these are topics that we could reasonably expect most people to be interested in, and that we might thus start to wonder who framed the terms of the discussion in such a way that the majority lost interest, leaving profoundly misconceived systems in place to drain the true wealth that supports all our lives…?

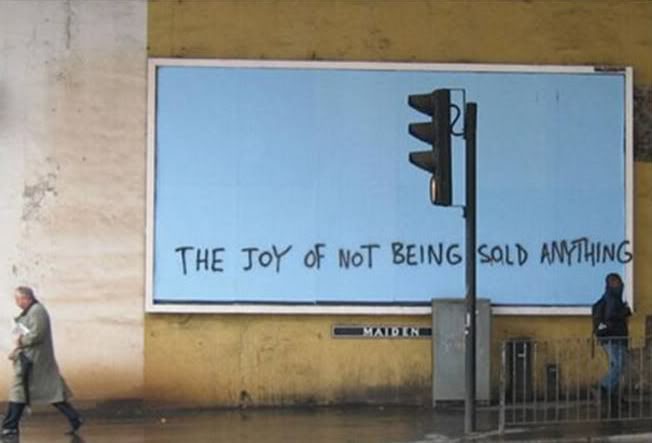

The fact that, for many, discussions of economics have appeared uninteresting and confusing is probably itself an important insight — one that points to a great deception. Those who shape the flows of money, labour and resources in our society have managed to convince us that the whole topic that shapes most people’s waking hours is, of all things, boring.

Which is why the accusations of parasitism and hypocrisy levelled at the Occupy movement in particular are so laughable. It is true that the Occupations only exist because of the popular support that supplies them with food, shelter etc (and even with Occupiers!). But to claim that those resources are provided from the largesse of free-market capitalism is ridiculous.

It is the dominant economic system that is the parasite, depending as it does entirely on the one economic system with a proven long-term track record of success. Not capitalism. Not communism. Nature.

People could originally build themselves a home, drink water that fell and flowed freely and source food directly for themselves, just like the other animals. Now, all the land is owned, the water is polluted and almost all sources of these essentials of life require money. Capitalism has not created the resources we require — it has co-opted them in order to sell back to us what was once truly free. If people choose to support each other in order to create a space to protest this and explore alternatives, then for the 1% to accuse them of parasitism is the height of hypocrisy.

The Transition approach to money, of course, has a far less oppositional energy than Occupy, seeking to bring together all elements of society in order to address our collective crises. This can be frustrating — meaning that initiatives sometimes move only at the speed of their least radical members — but it is essential to any collective transitional approach that wishes to avoid top-down enforcement. It is a truism to note that a society can only voluntarily change as fast as it is ready to.

For me, a big part of the beauty of Transition is that it brings together two groups of people with very different motivations — those who are working to make this society more sustainable, and those who are working to build an alternative to catch people when this society collapses. There are many things that these folk disagree on, but in Transition they seem to find the ability to enthusiastically collaborate on a great diversity of projects while they chew over those thorny disagreements.

My personal perception is that the first group may be shrinking — Derrick Jensen loves to ask who believes that our society will “undergo a voluntary transition to a sustainable way of living”, and claims that no-one ever raises their hand — but a gradual improvement towards sustainability is certainly still a widespread ambition.

What the Transition Money day got me pondering was whether Transition might be able to repeat the trick and team up another pair of very different viewpoints: those who are justifiably scared of collapse and its implications for themselves, their families and communities, and those who say they would welcome collapse, or even seek to hasten it, due to the damage that the current system is doing (e.g. around 50,000 species going extinct a year as we cause this planet’s sixth great mass extinction).

“We’ll be down to half the species of plants and animals by the end of the century if we keep at this rate” ~ E.O. Wilson

I suspect that these two perspectives can indeed work together, and the reports from Transition communities around Europe seemed to bear this out. Those who want to hasten collapse by attacking existing infrastructures seem to me to be clearly outside the Transition ethos, but there are other ways to hasten collapse. One is to work together to build alternatives. The more people flock to new alternative economies, the faster the old way loses the credibility which increasingly seems to be the only thing holding it up. As Buckminster Fuller put it, “You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete”. In combination with means of propagating the new models, this can be a powerful principle.

So for me, the most inspiring part of the day was meeting Filipa Pimentel of Portalegre em Transição (Portugal), who reported on just that process taking place there, with the gift economy expanding rapidly in response to many people’s inability to access money.

She outlined three principles developed in her local Transition initiative:

- They never turn anyone away due to lack of money (and facilitate schemes like ingredient swaps to help people support themselves in other ways).

- They never ask for (or accept) funding — they simply ask authorities and supporters to share access to their resources. They would never pay for a venue, on principle.

- Any financial resources they do come by will never be used to maintain existing models — if these can’t survive without money, let them fall. Instead those resources are used to build capacity for the gift economy.

Having been tested and found useful, these principles are rapidly being taken up by other initiatives. This strikes me as an appropriate style of local response, having grown directly out of local needs and now being communicated to other communities in the nation and around the world (Filipa also now co-ordinates networking between the national Transition hubs).

“The lesson from this is: if you want your economy to excel in the 21st century, for the IT, information-based high-tech sectors, a big banking sector, even a very successful banking system, is bad news for your economy”

It is intriguing to reflect on a culture which, faced with the classic argument of the financial sector: “We are the wealth creators, and if you tax us heavily, we will simply go elsewhere”, would respond, “Ok, bye then”.

When banks currently receive vastly far more in subsidies (without even considering bailouts) than they pay in tax, it surely shouldn’t be such an outlandish suggestion. Hopefully the below 50 second video clip (and the comments on YouTube!) might be seen as an indicator that the tide of public opinion is turning that way..

“Europe is and should be more about democracy than about financial markets … it was, in the end, clear that I had to choose democracy”

we here in England surely face a greater battle if we want to follow in their footsteps, with London sitting as perhaps the heart of the great global financial parasite, which has grown fat and powerful.

As Molly Scott Cato reminded us at last month’s event, Britain was the origin of both the industrial revolution and the financial revolution, and the cultural stories these birthed thus probably run deeper here than anywhere else. This is likely to shape our culture’s response as the worst begins to, quite literally, hit home (remember that in the UK, 94% of public service cuts and 88% of benefits cuts are reportedly yet to come).

We can see the significance of this already. Filipa reported that in Portugal people are tending to see the collapse of the financial economy as a ‘return to normal’ — learning to depend on each other again. Yet Phoebe Bright relayed that in Ireland the majority are refusing to countenance that this is anything more than a blip before things get back to a much younger view of ‘normality’ — being able to rely on money to meet our needs. The responses adopted differ accordingly.

To me, it was this clash of perspectives that was the take away message of the event. Transitioning Money must mean building both narratives and economic structures that empower people to step away from the crumbling mainstream and learn to trust in each other again, instead of in money. Portugal appears to be one place that is leading the way.

Great piece Shaun. However, I don’t know what I’m left with as the most disturbing element, the potential imminent economic meltdown, or that horrible picture of the skeleton lighting that woman’s cigarette. Where on earth did you find such a repellent image? Must have been taken in about 1978. I think it will haunt me for the rest of the day. That picture of the school sports day while the school burns down is surely the best image to represent the stupidity of the ‘British Stiff Upper Lip’ that I’ve ever seen. Wonderful. Doesn’t quite make up for the skeleton though.

Ha, apologies Rob! It’s from a quite astonishing photo set named “In Memory of the Late Mr. and Mrs. Comfort” by Richard Avedon in the New Yorker (1995). The rest can be seen here, but I don’t suppose you’ll be looking!

[…] From SHAUN CHAMBERLIN staging.www.darkoptimism.org […]

[…] As the inherently unsustainable financial economy continues to unravel, the people of England are not yet reaping the desperate consequences to the extent that those of Greece or India are, but it is growing even here, and it will come heavily home to this dark heart of the financial empire soon enough. For many, ‘austerity’ is already biting hard. […]

Not sure how I fell across this piece but surely glad I did! Hard to believe it was written 6 years back.

[…] – ripped off by the banks, burdened with huge debts and struggling to find decent employment. As the inherently unsustainable financial economy continues to unravel, the people of England are not yet reaping the desperate consequences to the extent that those of […]