by Shaun Chamberlin | Nov 5, 2011 | All Posts, Climate Change, Cultural stories, Economics, Favourite posts, Peak Oil, Politics, Transition Movement

This post was written for the Transition Network's Social Reporting project, and published there on Sunday 13th November.

---

Having been invited to be this week's Social Reporting guest editor and introduce the theme of economics, the burgeoning 'Occupy' movement seemed the obvious place to start.

Over the last couple of months I have been fascinated as the occupations started with OccupyWallStreet on Sept 17th, followed by others joining in solidarity around the world, including OccupyLondon, which has been the London Stock Exchange's new neighbour since Oct 15th.

I've not been well lately, so haven't been able to be there as much as I'd like, but I have been following events closely online and visiting when I can. It has been interesting to note that most of those I have met at OccupyLondon hadn't previously heard of Transition, and that got me thinking about the parallels and differences between the two movements...

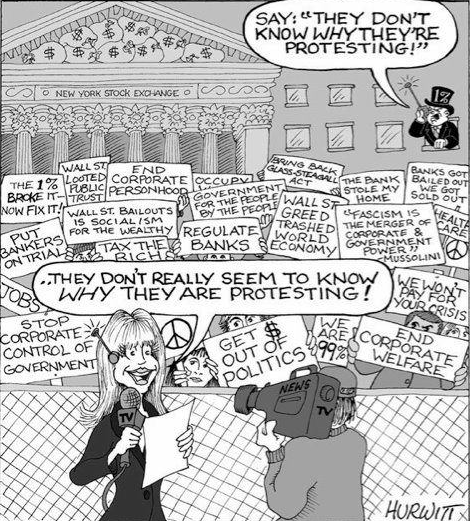

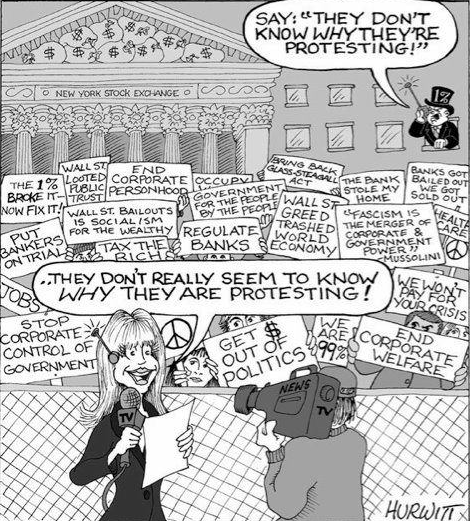

So what is 'Occupy' all about? A lot has been made in the mainstream media about the elusive "one demand" that Adbusters referred to in the original image that sparked the movement, and the ensuing lack of a single clear demand to fulfil that call.

And yet the basic point comes through loud and clear. Our economic system is profoundly unfair, and we want profound change. We live under a system in which banks receive more in subsidies than they pay in taxes, where they use their power to actually create money out of thin air, where they receive hundreds of billions in bailouts, and where the graph of global income distribution looks, well, like this:

And yet the basic point comes through loud and clear. Our economic system is profoundly unfair, and we want profound change. We live under a system in which banks receive more in subsidies than they pay in taxes, where they use their power to actually create money out of thin air, where they receive hundreds of billions in bailouts, and where the graph of global income distribution looks, well, like this:

It is easy to see why 'the 99%' might have something to say to 'the 1%' (the spike on the right should actually continue upwards over ten thousand times as far as shown here, or more than a kilometre above your computer!), and it also easy for us to let our brains boggle at numbers in the hundreds of billions of pounds. What can such numbers really mean? Yet Occupy has learned the hard way that they can become terribly real when we see some of the things that this virtually unlimited money is used for.

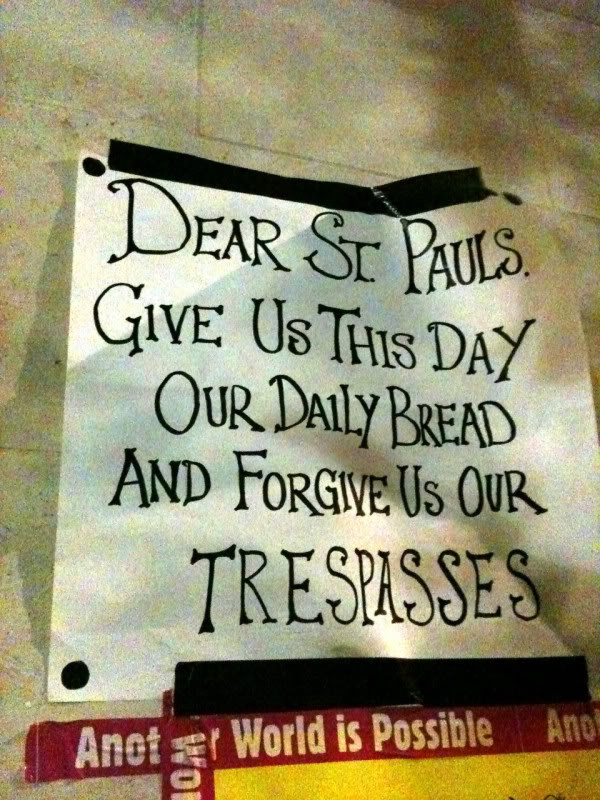

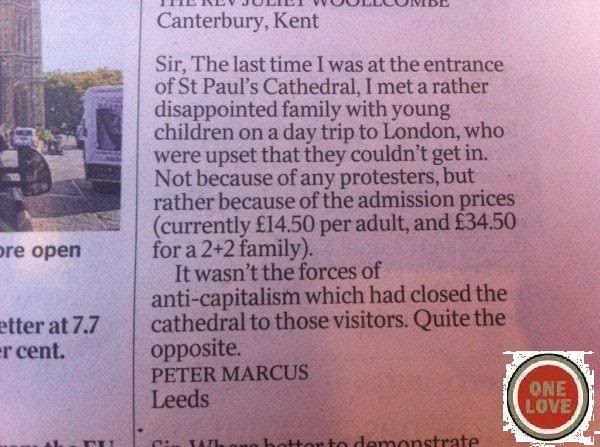

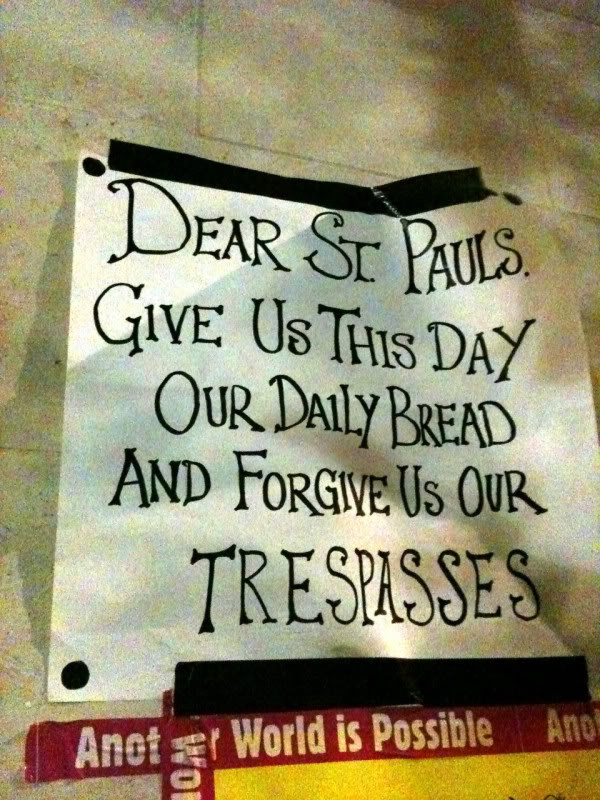

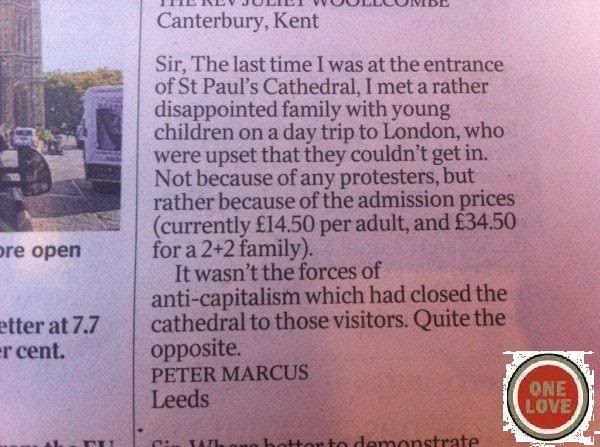

For example, the New York Police Department, which has been increasingly violent in its treatment of OccupyWallSt, was given a $4.6m donation by bailed-out Wall Street megabank JP Morgan Chase, and the New York Stock Exchange and Wall Street corporations apparently now actually hire individual serving policemen for $37/hr. Such riches also permit the big financial institutions to appear generous by becoming the chief sponsors of organisations like St. Paul's Cathedral. Not to mention of course that more than 99% of us work for money, which is apparently being magicked out of thin air by others, who then use this free resource to pay the rest of us to do whatever they see fit.

It suddenly becomes crystal clear why the Oakland public were chanting "who are you protecting?" as the Oakland police force closed in to attack them for being in the streets of Oakland, threatening the use of "chemical agents" via a megaphone and throwing a flash grenade at those trying to help a wounded man:

Witnesses (AKA social reporters!) claim that one protester actually threw dollar bills at the police line while shouting "will you protect us now?" Incidentally, on the same day, on this side of the pond, Sky News were busy telling Occupy London campers that "what you're doing is imposing your will on everybody else in a similar way (to the Nazis)". Hm. Reasons abound for us to do our own reporting!

Now, at first glance, all this confrontation might seem a world away from working diligently to improve the resilience of our local communities, but I believe that the links are strong, and I hope to see them grow even stronger. Let me explain why.

Both Transition and Occupy are founded on a belief that the current economic system is leading us to a future that none of us desire and, although peak oil seems to be a new term to many of those at OccupyLondon, we also share a strong strand of concern over climate change.

The big question for OccupyLondon though is what next? Substantial public support has helped resist the attempts of the Church of England and Corporation of London to have them moved on, and with St. Paul's having conceded that the camp presents no reason for the Cathedral to close its doors, Occupy London has established a site, at least for now. But what to do with it?

It is easy to see why 'the 99%' might have something to say to 'the 1%' (the spike on the right should actually continue upwards over ten thousand times as far as shown here, or more than a kilometre above your computer!), and it also easy for us to let our brains boggle at numbers in the hundreds of billions of pounds. What can such numbers really mean? Yet Occupy has learned the hard way that they can become terribly real when we see some of the things that this virtually unlimited money is used for.

For example, the New York Police Department, which has been increasingly violent in its treatment of OccupyWallSt, was given a $4.6m donation by bailed-out Wall Street megabank JP Morgan Chase, and the New York Stock Exchange and Wall Street corporations apparently now actually hire individual serving policemen for $37/hr. Such riches also permit the big financial institutions to appear generous by becoming the chief sponsors of organisations like St. Paul's Cathedral. Not to mention of course that more than 99% of us work for money, which is apparently being magicked out of thin air by others, who then use this free resource to pay the rest of us to do whatever they see fit.

It suddenly becomes crystal clear why the Oakland public were chanting "who are you protecting?" as the Oakland police force closed in to attack them for being in the streets of Oakland, threatening the use of "chemical agents" via a megaphone and throwing a flash grenade at those trying to help a wounded man:

Witnesses (AKA social reporters!) claim that one protester actually threw dollar bills at the police line while shouting "will you protect us now?" Incidentally, on the same day, on this side of the pond, Sky News were busy telling Occupy London campers that "what you're doing is imposing your will on everybody else in a similar way (to the Nazis)". Hm. Reasons abound for us to do our own reporting!

Now, at first glance, all this confrontation might seem a world away from working diligently to improve the resilience of our local communities, but I believe that the links are strong, and I hope to see them grow even stronger. Let me explain why.

Both Transition and Occupy are founded on a belief that the current economic system is leading us to a future that none of us desire and, although peak oil seems to be a new term to many of those at OccupyLondon, we also share a strong strand of concern over climate change.

The big question for OccupyLondon though is what next? Substantial public support has helped resist the attempts of the Church of England and Corporation of London to have them moved on, and with St. Paul's having conceded that the camp presents no reason for the Cathedral to close its doors, Occupy London has established a site, at least for now. But what to do with it?

The mainstream media have been clamouring for a list of demands, yet I and many others find it refreshing that none has yet been forthcoming.

I fear that setting demands is tantamount to saying "give us this much and then we will go home and allow the destruction that is business as usual to continue". For example, there is growing momentum behind calls for Occupy to demand a 'Robin Hood tax'. Yet as banks can and do create money it seems that demanding a fraction back might amount to selling ourselves for nothing.

The mainstream media have been clamouring for a list of demands, yet I and many others find it refreshing that none has yet been forthcoming.

I fear that setting demands is tantamount to saying "give us this much and then we will go home and allow the destruction that is business as usual to continue". For example, there is growing momentum behind calls for Occupy to demand a 'Robin Hood tax'. Yet as banks can and do create money it seems that demanding a fraction back might amount to selling ourselves for nothing.

"There is always an easy solution to every human problem — neat, plausible, and wrong" ~ H. L. Mencken

Given the mess things are in, it seems absurd to expect a simple set of demands that could put it all right. Instead, OccupyLondon has as yet adopted what seems to me a far more mature approach - setting up teach-ins and a 'university' in which we can educate ourselves, and then giving the resultant discussions as long as they need. It says to the guardians of the status quo "Ok, no, we don't have all the answers, but it's abundantly clear that you don't either, so let's talk it over."

And it's here where I fancy Transitioners might have a few things to say (as well as much to learn!) with our growing experience of building local economic networks that make a lot more sense than this globalised mess:

The first thing that I think Transitioners can usefully contribute to the discussions is an awareness of the energy limits that we are facing, and what they mean for the possibility of continued economic growth (even leaving aside the question of its desirability). If Occupy became just a mass demand for the politicians to roll back the cuts and rescue those who have been abandoned, it might be set to fail, because the era of increasing energy abundance is over, whatever politicians might say or do.

On the other hand, if Occupy recognises the inherent problem of protesting against the system your lifestyle depends upon, then the conversation goes to a much more interesting place - can we build alternative, independent systems to support us, even in a period of energy descent? This is where Transition's five years of experience might be most helpful.

As Sharon Astyk put it:

"The reality is that the growth we've lived with is going away whether we like it or not - I'm hoping that this new emergent consensus that we've been screwed comes with a collective response to the end of growth - or the solidarity won't last as the system pits people against one another"

So on that note, I hand over to the social reporters to explore this week's topic of Transition economics. From local e-currencies to the gift economy - what can we bring to the discussion that is sweeping the world?

Blogs posted in response by other Transitioners:

The local Heathrow economy - Nov 14, 2011

Ye are many - they are few - Nov 15, 2011

just another brick in the wall (street) - Nov 15, 2011

Our Money Our Future - Money for the 99% by the 99% - Nov 17, 2011

Time to Get to Work - Nov 18, 2011

We Can't Eat Money - Nov 19, 2011

--

Edit - On Nov 9, Rob Hopkins and I did a joint presentation on Transition at OccupyLondon. Rob's report, including an interview with me, can be found here.

Blogs posted in response by other Transitioners:

The local Heathrow economy - Nov 14, 2011

Ye are many - they are few - Nov 15, 2011

just another brick in the wall (street) - Nov 15, 2011

Our Money Our Future - Money for the 99% by the 99% - Nov 17, 2011

Time to Get to Work - Nov 18, 2011

We Can't Eat Money - Nov 19, 2011

--

Edit - On Nov 9, Rob Hopkins and I did a joint presentation on Transition at OccupyLondon. Rob's report, including an interview with me, can be found here.

by Shaun Chamberlin | Feb 11, 2011 | All Posts, Cultural stories, Reviews and recommendations, The Transition Timeline, Transition Movement

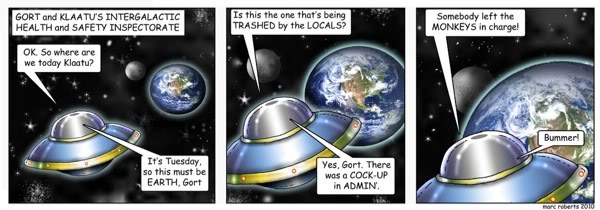

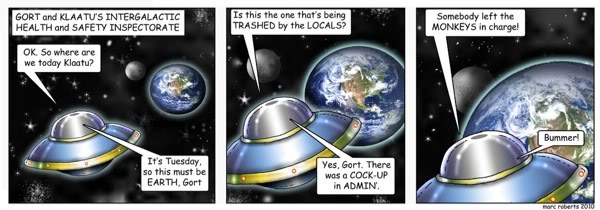

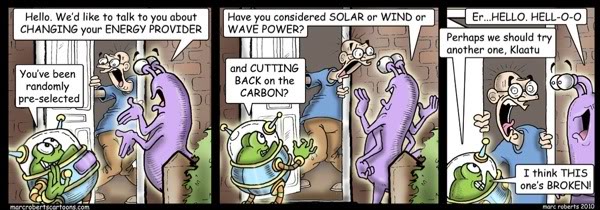

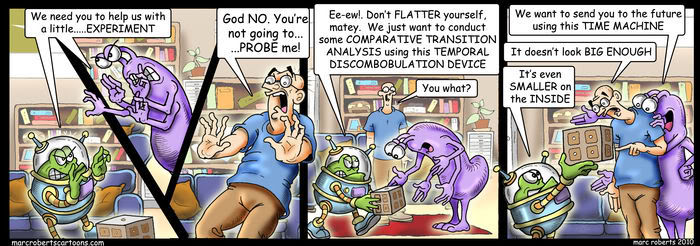

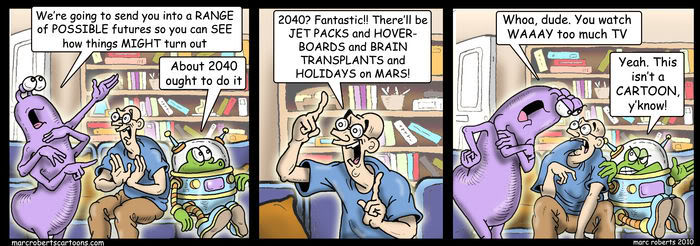

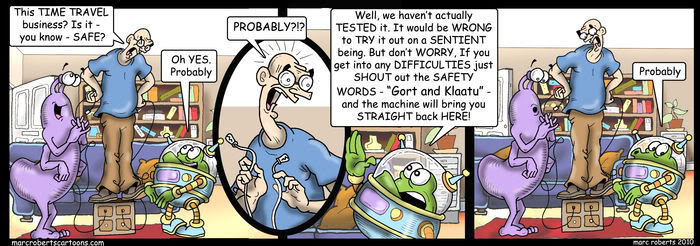

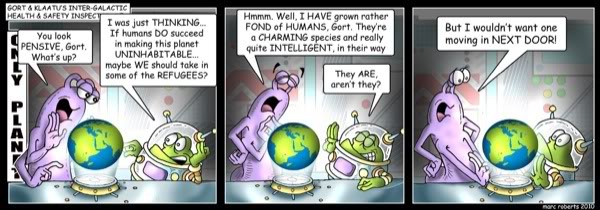

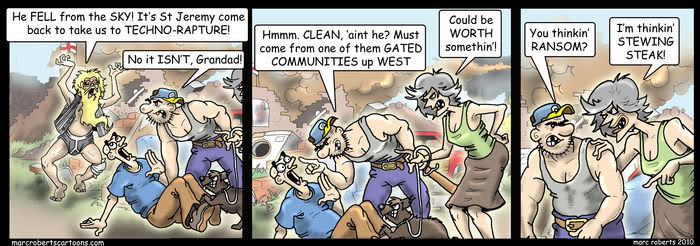

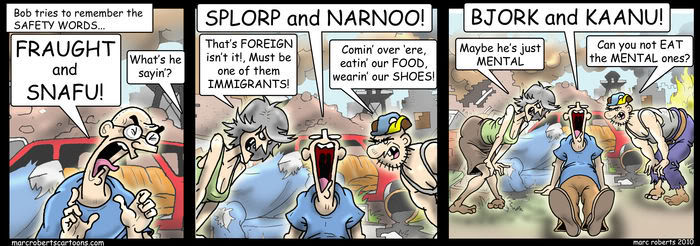

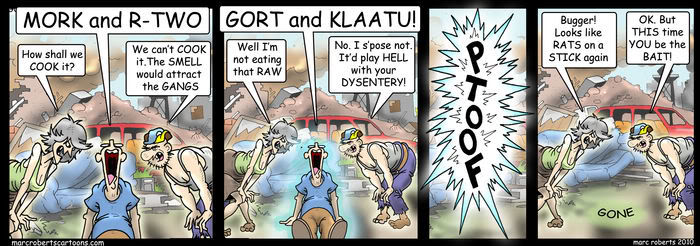

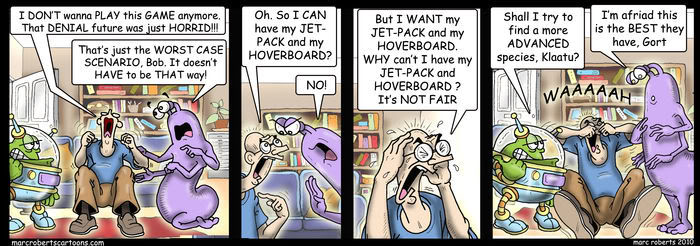

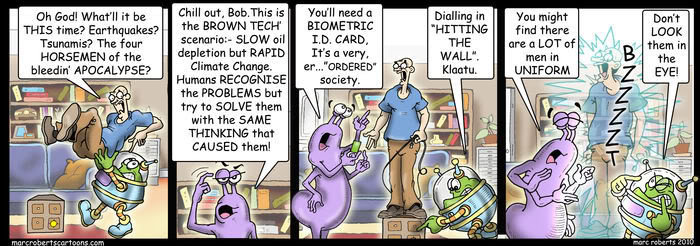

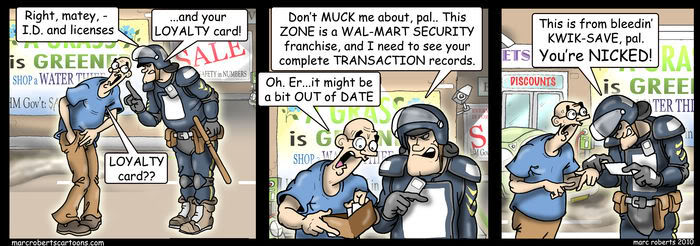

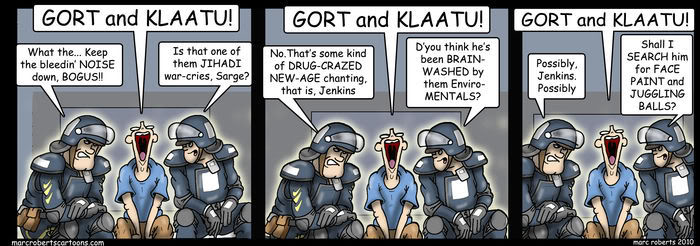

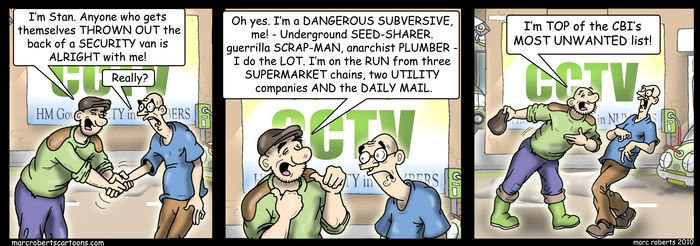

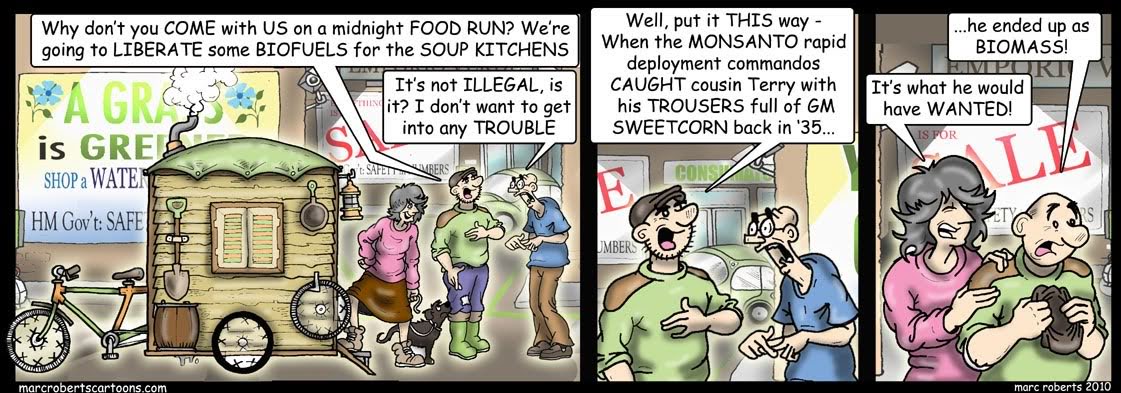

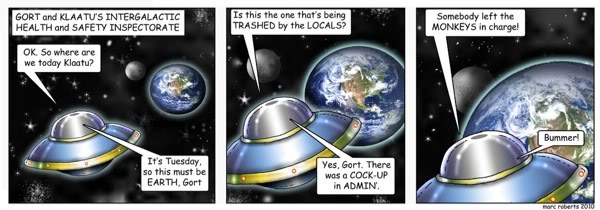

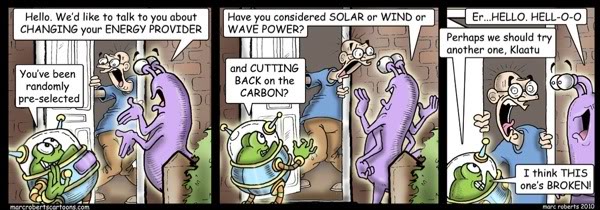

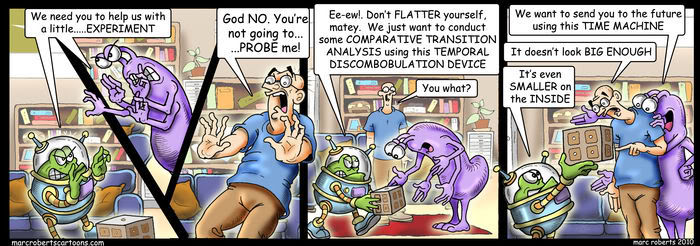

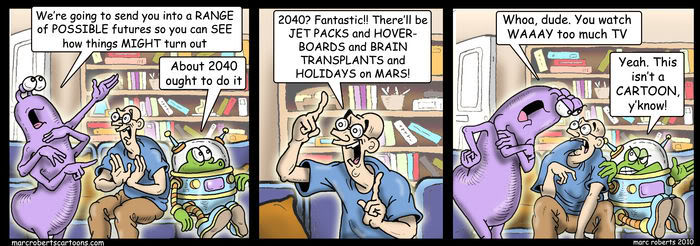

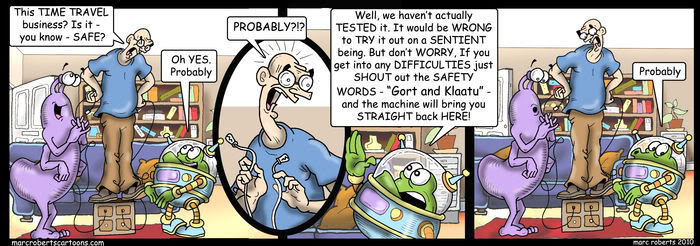

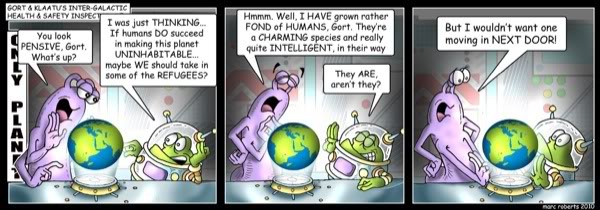

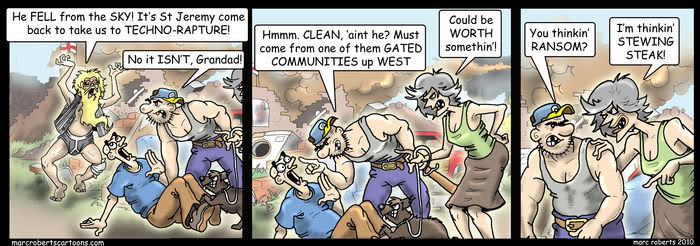

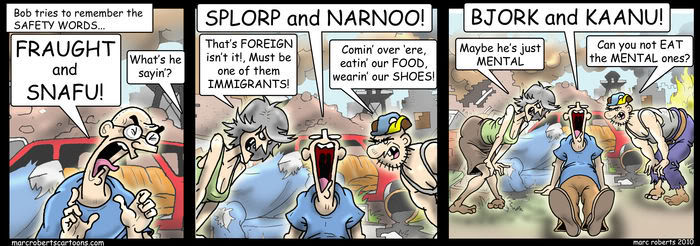

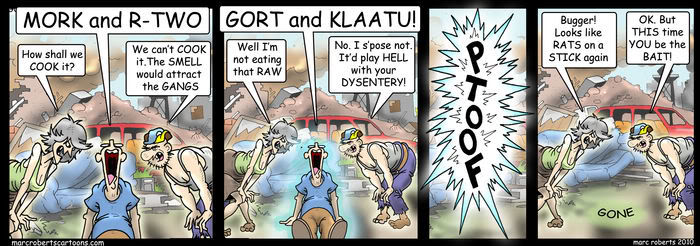

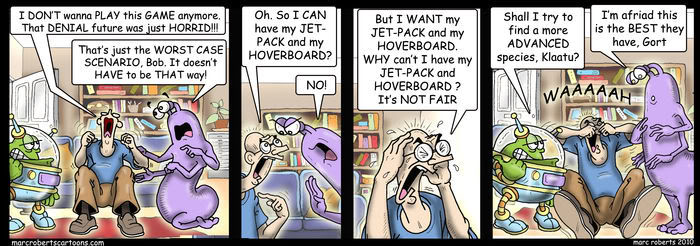

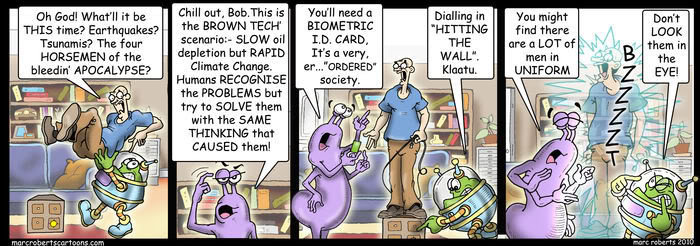

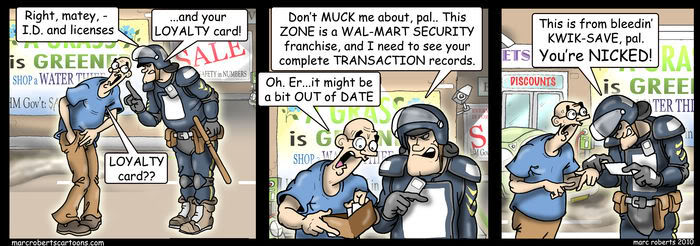

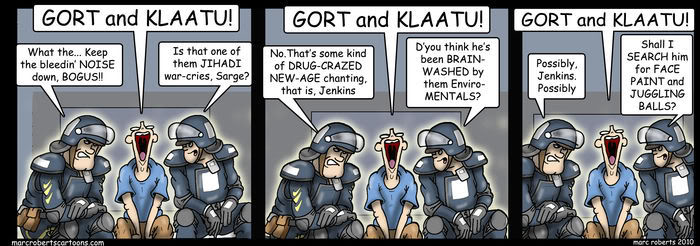

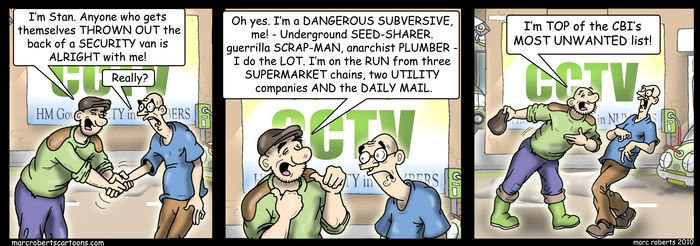

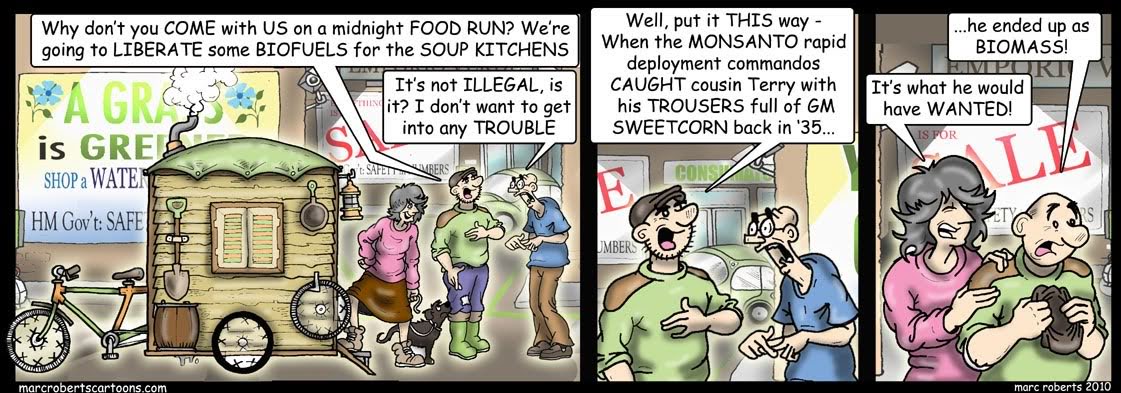

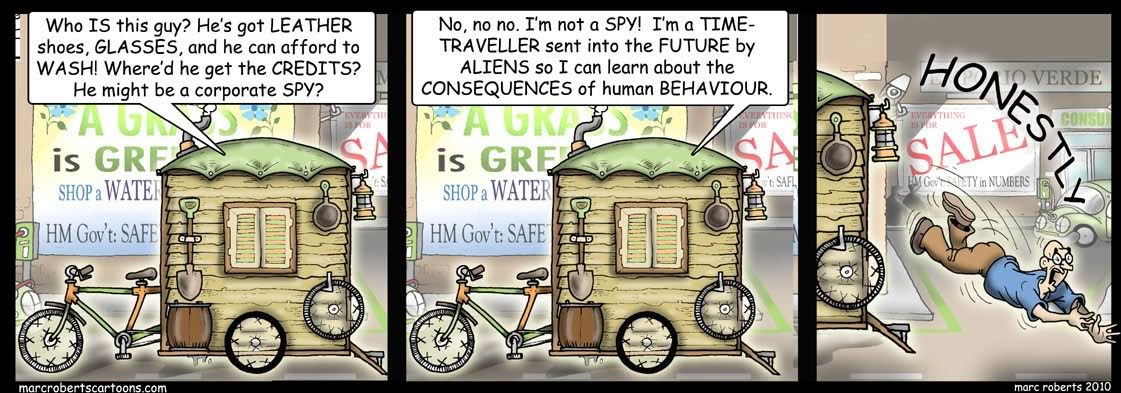

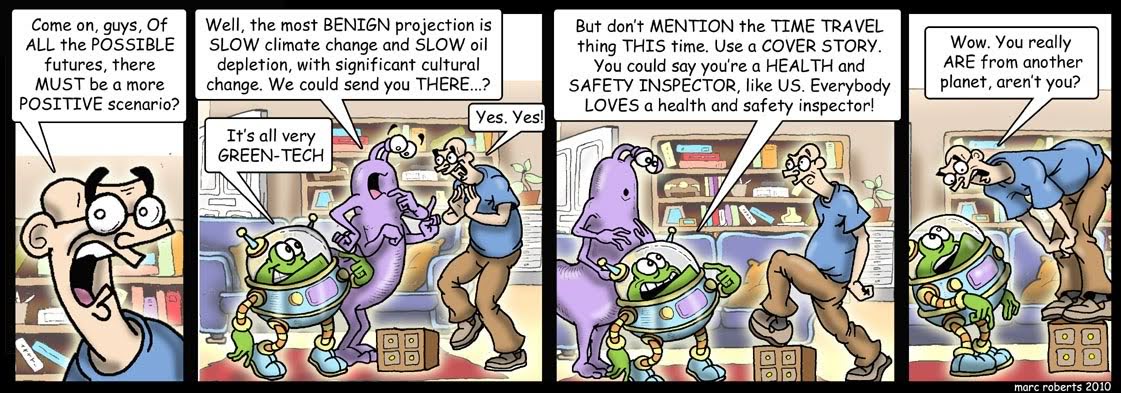

The brilliant cartoonist Marc Roberts (whose work will be familiar to regular Dark Optimism readers) got in touch with the Transition Network last year offering to produce a strip exploring the Transition concept. The time has come for the results to be unleashed on an unsuspecting public!

In Marc's own words, "they will be loosely exploring some of the Holmgren and Chamberlin scenarios through my usual combination of toilet humour and sarcasm".

He does himself a disservice - for me, it's a real honour to see my work used by someone whose talents I have long admired and enjoyed.

Two cartoons will be released each week. This post will be updated with the new cartoons as they are released, and they will also go out on Rob Hopkins' Transition Culture site and on a Transition Network blog.

The first four (+ a special message from the Inspectorate) are below. Hope you enjoy them!

Mon 7 Feb

(click to expand each strip)

(click to expand each strip)

Letter to Earthlings from the Intergalactic Heath & Safety Inspectorate

To whom it may concern,

Your planet has been selected for an extended audit by the Intergalactic Health & Safety Inspectorate, a worker-owned cooperative originating from a distant galaxy.

My colleague Gort and I have much work ahead and we will need to communicate our progress to you. Our studies of your culture indicate that your pictures paint a thousand words, so we will be using cartoons to convey our message.

We've therefore randomly selected an earthling to chronicle our adventures and given him special cartooning powers. He is working from a safe house deep in the discombobulation matrix and when our work here is done, we'll endeavour to return him to Manchester with most of his main parts intact.

So from now on, our adventures - starting below - will come to you in this medium.

And don't be alarmed if you see us on your doorstep, we may be making housecalls in your area shortly...

Yours intergalactically,

Klaatu

- Primitive Species Specialist, Dept of Planetary Remediation

- Intergalactic Health & Safety Inspectorate, Upsilon Andromedae Sector

Fri 11 Feb

Mon 14 Feb

Fri 18 Feb

Mon 21 Feb

Mon 28 Feb

Mon 7 Mar

Mon 14 Mar

Mon 28 Mar

Mon 4 Apr

Mon 11 Apr

Mon 25 Apr

Mon 9 May

Mon 30 May

This is as far as Marc Roberts has drawn this story for now! Drop him a positive comment here if you'd like to see more!

Edit - Sun 4 Dec:

by Shaun Chamberlin | Jul 7, 2010 | All Posts, Peak Oil, TEQs (Tradable Energy Quotas)

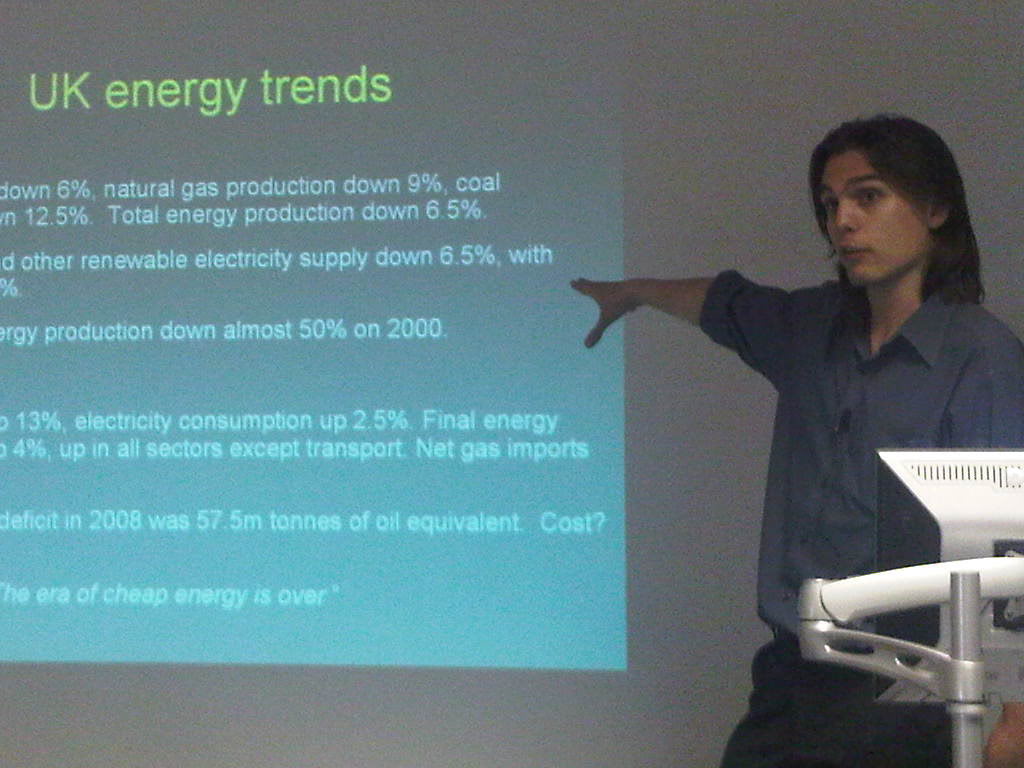

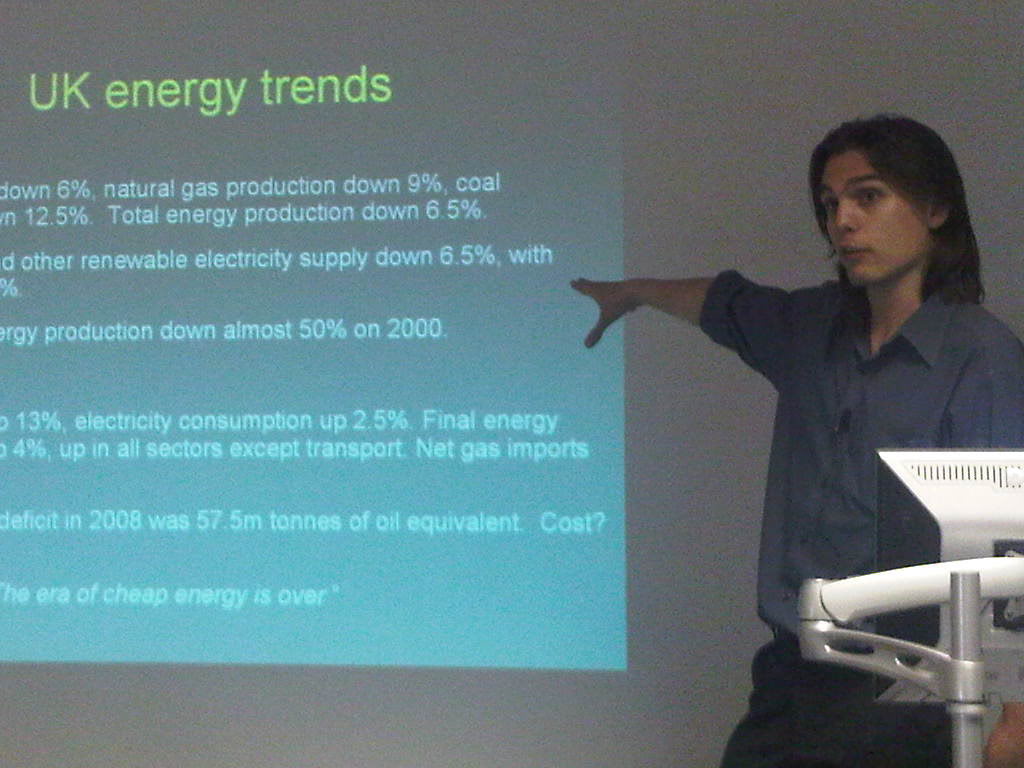

The slides and audio are now available from the seminar David Fleming and I gave at the London School of Economics last week.

The topic was "Transition Towns and Tradable Energy Quotas: Frameworks to support a diversity of small-scale solutions to the large-scale problems of peak oil and climate change".

Note that the slides are mis-numbered on the LSE site, so my opening section is Audio Part 1 (which begins with introductions from those present) and Slides Part 2, and David's is Audio Part 2 and Slides Part 1!

My section was a half-hour run-through of climate change, peak energy, finance and the Transition response, much of which will be familiar to regular readers, but delivered to an interesting (and interested) new audience.

by Shaun Chamberlin | Jun 15, 2010 | All Posts, Economics, Favourite posts, Peak Oil, Transition Movement

This post was originally written by me as a guest post for Rob Hopkins' Transition Culture blog, but I have kindly given myself permission to reproduce it here ;)

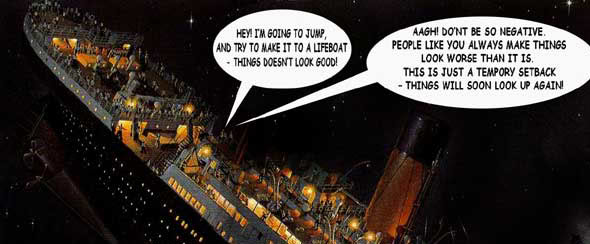

So here I am. I fully intended to be giving the England match my full attention right now, but I've been left distinctly restive by this afternoon's long session by Stoneleigh of The Automatic Earth, and feel the need to put some thoughts down.

Including the extensive Q&A session her talk lasted virtually three hours and covered a lot of ground, starting from a good runthrough of the 'peak energy' situation, but quickly focusing in on finance, as she believes that this is the factor that will most dramatically shape our immediate future. Notably, the talk attracted almost half the attendees of the Transition Conference, despite the numerous other Open Space sessions taking place at the same time.

For me her analysis helped to bridge the gap between comprehension and real understanding. I always feel that I don't have a genuine opinion on something until I can listen to someone argue one point of view, then listen to someone argue the opposite, and truly understand what the root of their disagreement is, so that I can make up my own mind. With finance I have always felt unable to get to the root of the disagreement between those who forecast a cataclysm in the coming years, and those who argue that the system is far more resilient than some give it credit for.

That feeling has not been totally banished, but Stoneleigh (both today and in a bar-room chat until 2am last night) really helped me to close some big gaps.

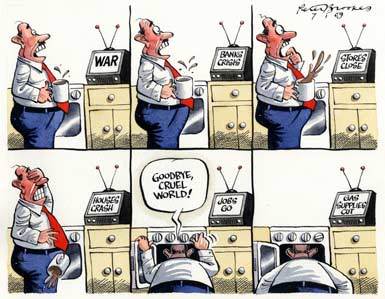

She has agreed to email me her slides, but essentially her position is that we are just slipping over the edge into the greatest financial Depression the world has ever seen, off the back of the biggest financial bubble the world has ever seen. This will, of course, bring significant personal consequences for individuals, families and communities.

Consequently, her absolute #1 piece of advice to all and sundry is to get out of debt, as debts that may seem manageable now are unlikely to remain so as interest rates soar and property prices plummet (perhaps back to somewhere in the region of their 1970 values). Meanwhile, existing mortgage debts will stubbornly remain just as large, leaving many people in the ordeal of negative equity - their mortgage debt being bigger than the value of their house.

She also explained the 'derivatives' market in a usefully clear way. Whereas many of the world's money-making schemes are based on cutting the proverbial cake into smaller and smaller slices, this system is based on giving more and more people rights over a single slice of cake. As this system unravels (as it surely must at some point, since not every claimant can have their cake to eat it), the bulk of the world's money will essentially disappear, creating huge deflation. There will be less money in circulation relative to the amount of stuff, so the value of the money that people do have will actually go up, while earnings drop. As she pointed out, the key issue to be concerned with is 'affordability' not inflation, deflation, wages or anything else. How much useful stuff can you buy with what you have?

While not explicit about it as such, she seemed to be ranking the kinds of assets we might hold in terms of risk. In order, starting with the most desirable, that list was:

Useful assets - e.g. tools, land, a home that you want to live in, and that can supply what you need etc...

Cash - as deflation is likely to raise the value of cash, it's a good thing to have, but cash in bank accounts is quite liable to evaporate. In response to the inevitable question of where we should keep cash, her repeated answer was "be creative".

Gilts - Given that holding massive amounts of cash is both impractical and likely to arouse suspicion, she suggested gilts as the next least-risky place to put money.

Interestingly though, she believes that while useful productive assets are the most important thing (these are, after all, the source of our ability to support our communities and ourselves), she also pointed out that the price of such assets is likely to drop as the crisis tightens.

Consequently, her absolute #1 piece of advice to all and sundry is to get out of debt, as debts that may seem manageable now are unlikely to remain so as interest rates soar and property prices plummet (perhaps back to somewhere in the region of their 1970 values). Meanwhile, existing mortgage debts will stubbornly remain just as large, leaving many people in the ordeal of negative equity - their mortgage debt being bigger than the value of their house.

She also explained the 'derivatives' market in a usefully clear way. Whereas many of the world's money-making schemes are based on cutting the proverbial cake into smaller and smaller slices, this system is based on giving more and more people rights over a single slice of cake. As this system unravels (as it surely must at some point, since not every claimant can have their cake to eat it), the bulk of the world's money will essentially disappear, creating huge deflation. There will be less money in circulation relative to the amount of stuff, so the value of the money that people do have will actually go up, while earnings drop. As she pointed out, the key issue to be concerned with is 'affordability' not inflation, deflation, wages or anything else. How much useful stuff can you buy with what you have?

While not explicit about it as such, she seemed to be ranking the kinds of assets we might hold in terms of risk. In order, starting with the most desirable, that list was:

Useful assets - e.g. tools, land, a home that you want to live in, and that can supply what you need etc...

Cash - as deflation is likely to raise the value of cash, it's a good thing to have, but cash in bank accounts is quite liable to evaporate. In response to the inevitable question of where we should keep cash, her repeated answer was "be creative".

Gilts - Given that holding massive amounts of cash is both impractical and likely to arouse suspicion, she suggested gilts as the next least-risky place to put money.

Interestingly though, she believes that while useful productive assets are the most important thing (these are, after all, the source of our ability to support our communities and ourselves), she also pointed out that the price of such assets is likely to drop as the crisis tightens.

Accordingly, she counselled that one possible course of action for those unable to afford the productive assets they need (land, say) without going into debt, could be to minimise their exposure to the crash, preserve any cash that they can, and then buy more cheaply further down the slope. Those who can afford to buy outright now though, would be well-advised to do so, as while their assets, land etc. may decrease in value, this is of less significance if they plan to hold on to these assets long-term anyway, and in return they are buying themselves time to learn to use these 'tools', before they are relying on them.

As she spoke, the room was hushed and fiercely attentive, and you could see people absorbing the implications of what she said for their own financial plans, and those of their communities and families.

One very interesting question was from a Transitioner who is considering setting up a community-owned renewables project, based on taking out a loan to install PV, and paying back the loan on the basis of the Government's feed-in tariffs. Stoneleigh argued that in the current situation, any Government guarantee to do anything over the next 20-25 years is barely worth the paper it's written on, and so she would advise that such projects should be undertaken either without going into debt or not at all.

Above all, she stressed the urgency of the situation, and that we should not expect the financial situation to look at all like it does now in just a couple of years time.

Accordingly, she counselled that one possible course of action for those unable to afford the productive assets they need (land, say) without going into debt, could be to minimise their exposure to the crash, preserve any cash that they can, and then buy more cheaply further down the slope. Those who can afford to buy outright now though, would be well-advised to do so, as while their assets, land etc. may decrease in value, this is of less significance if they plan to hold on to these assets long-term anyway, and in return they are buying themselves time to learn to use these 'tools', before they are relying on them.

As she spoke, the room was hushed and fiercely attentive, and you could see people absorbing the implications of what she said for their own financial plans, and those of their communities and families.

One very interesting question was from a Transitioner who is considering setting up a community-owned renewables project, based on taking out a loan to install PV, and paying back the loan on the basis of the Government's feed-in tariffs. Stoneleigh argued that in the current situation, any Government guarantee to do anything over the next 20-25 years is barely worth the paper it's written on, and so she would advise that such projects should be undertaken either without going into debt or not at all.

Above all, she stressed the urgency of the situation, and that we should not expect the financial situation to look at all like it does now in just a couple of years time.

In my one-to-one chat with her on Friday night, I asked her about my Student Loan, which is currently about the most benign loan imaginable, with a rate of interest generally lower than that available on tax-free savings accounts. She argued that I should pay it off as soon as possible nonetheless, even if that takes all the money I have, as savings in the bank are at a significant risk of disappearing, whereas loans never die. Indeed, they tend to be sold on down the line until you find yourself in debt to someone rather unpleasant.

We also talked about the best ways forward, given the difficult situation in which we find ourselves. We both believe that social ties are the most valuable asset we can possibly have, and that building these networks of trust is the most important work we can do.

She spoke of the example of the Great Depression of the 1930s, in which despite an abundance of food, fuel, resources and manpower, the whole system ground to a halt due to the unavailability of money to connect buyers and sellers. It reached the point where farmers were pouring away perfectly good milk while people starved up the road.

This put me in mind of Mark Boyle, the Moneyless Man, who I finally met for the first time at the Uncivilisation festival a couple of weeks ago. It strikes me that the simple idea of the gift economy - or Freeconomy - that he is practising, is exactly what was needed in that situation. If the farmers and the hungry had trusted each other, then without money, or indeed any other kind of transaction, a human can give another human food just for the love of it. And if the farmer needed help on his farm, then others might help for similar reasons. Perhaps if those needs coincide then barter might take place, but where they do not, the simple desire to help each other, and the trust that others will help out when you need something, could have got that society functioning again.

In my one-to-one chat with her on Friday night, I asked her about my Student Loan, which is currently about the most benign loan imaginable, with a rate of interest generally lower than that available on tax-free savings accounts. She argued that I should pay it off as soon as possible nonetheless, even if that takes all the money I have, as savings in the bank are at a significant risk of disappearing, whereas loans never die. Indeed, they tend to be sold on down the line until you find yourself in debt to someone rather unpleasant.

We also talked about the best ways forward, given the difficult situation in which we find ourselves. We both believe that social ties are the most valuable asset we can possibly have, and that building these networks of trust is the most important work we can do.

She spoke of the example of the Great Depression of the 1930s, in which despite an abundance of food, fuel, resources and manpower, the whole system ground to a halt due to the unavailability of money to connect buyers and sellers. It reached the point where farmers were pouring away perfectly good milk while people starved up the road.

This put me in mind of Mark Boyle, the Moneyless Man, who I finally met for the first time at the Uncivilisation festival a couple of weeks ago. It strikes me that the simple idea of the gift economy - or Freeconomy - that he is practising, is exactly what was needed in that situation. If the farmers and the hungry had trusted each other, then without money, or indeed any other kind of transaction, a human can give another human food just for the love of it. And if the farmer needed help on his farm, then others might help for similar reasons. Perhaps if those needs coincide then barter might take place, but where they do not, the simple desire to help each other, and the trust that others will help out when you need something, could have got that society functioning again.

But as Stoneleigh pointed out, the key is building that trust ahead of time. In difficult times, your bonds with those you trust naturally becomes even tighter, as you rely on each other more, but your mistrust for those outside your circle can also increase, as you worry that perhaps they are just after what little you have.

Transition has always sought to widen and strengthen those circles, and that still looks like the most important work we can be doing, but Stoneleigh hopes to suggest a few tweaks to our tactics, as well as underscoring the sense of urgency.

A number of other Transitioners have already spoken to me about being rather shaken by Stoneleigh's talk, but as she kept emphasising, we are doing the right work. Critical work.

(Edit - 03/10/10 Stoneleigh's powerful talk is now available for purchase here.)

ps And England drew 1-1, but somehow that doesn't seem like the most important thing I learnt today!

But as Stoneleigh pointed out, the key is building that trust ahead of time. In difficult times, your bonds with those you trust naturally becomes even tighter, as you rely on each other more, but your mistrust for those outside your circle can also increase, as you worry that perhaps they are just after what little you have.

Transition has always sought to widen and strengthen those circles, and that still looks like the most important work we can be doing, but Stoneleigh hopes to suggest a few tweaks to our tactics, as well as underscoring the sense of urgency.

A number of other Transitioners have already spoken to me about being rather shaken by Stoneleigh's talk, but as she kept emphasising, we are doing the right work. Critical work.

(Edit - 03/10/10 Stoneleigh's powerful talk is now available for purchase here.)

ps And England drew 1-1, but somehow that doesn't seem like the most important thing I learnt today!

Shaun is a co-founder of Transition Town Kingston and the author of The Transition Timeline. He writes at www.darkoptimism.org

Shaun is a co-founder of Transition Town Kingston and the author of The Transition Timeline. He writes at www.darkoptimism.org

by Shaun Chamberlin | Jun 9, 2010 | All Posts, Climate Change, Cultural stories, Favourite posts, Peak Oil, TEQs (Tradable Energy Quotas), The Transition Timeline, Transition Movement

http://www.darkoptimism.org/wp-content/uploads/2020/10/10-03-26-Radio-EcoShock_Chamberlin_LoFi.mp3 Christopher Fraser of London Transition has kindly transcribed the above popular interview with Canada’s Radio Ecoshock that I posted a couple of months back....

And yet the basic point comes through loud and clear. Our economic system is profoundly unfair, and we want profound change. We live under a system in which banks receive more in subsidies than they pay in taxes, where they use their power to actually create money out of thin air, where they receive hundreds of billions in bailouts, and where the graph of global income distribution looks, well, like this:

And yet the basic point comes through loud and clear. Our economic system is profoundly unfair, and we want profound change. We live under a system in which banks receive more in subsidies than they pay in taxes, where they use their power to actually create money out of thin air, where they receive hundreds of billions in bailouts, and where the graph of global income distribution looks, well, like this:

It is easy to see why 'the 99%' might have something to say to 'the 1%' (the spike on the right should actually continue upwards over ten thousand times as far as shown here, or more than a kilometre above your computer!), and it also easy for us to let our brains boggle at numbers in the hundreds of billions of pounds. What can such numbers really mean? Yet Occupy has learned the hard way that they can become terribly real when we see some of the things that this virtually unlimited money is used for.

For example, the New York Police Department, which has been increasingly violent in its treatment of OccupyWallSt, was given a $4.6m donation by bailed-out Wall Street megabank JP Morgan Chase, and the New York Stock Exchange and Wall Street corporations apparently now actually hire individual serving policemen for $37/hr. Such riches also permit the big financial institutions to appear generous by becoming the chief sponsors of organisations like St. Paul's Cathedral. Not to mention of course that more than 99% of us work for money, which is apparently being magicked out of thin air by others, who then use this free resource to pay the rest of us to do whatever they see fit.

It suddenly becomes crystal clear why the Oakland public were chanting "who are you protecting?" as the Oakland police force closed in to attack them for being in the streets of Oakland, threatening the use of "chemical agents" via a megaphone and throwing a flash grenade at those trying to help a wounded man:

It is easy to see why 'the 99%' might have something to say to 'the 1%' (the spike on the right should actually continue upwards over ten thousand times as far as shown here, or more than a kilometre above your computer!), and it also easy for us to let our brains boggle at numbers in the hundreds of billions of pounds. What can such numbers really mean? Yet Occupy has learned the hard way that they can become terribly real when we see some of the things that this virtually unlimited money is used for.

For example, the New York Police Department, which has been increasingly violent in its treatment of OccupyWallSt, was given a $4.6m donation by bailed-out Wall Street megabank JP Morgan Chase, and the New York Stock Exchange and Wall Street corporations apparently now actually hire individual serving policemen for $37/hr. Such riches also permit the big financial institutions to appear generous by becoming the chief sponsors of organisations like St. Paul's Cathedral. Not to mention of course that more than 99% of us work for money, which is apparently being magicked out of thin air by others, who then use this free resource to pay the rest of us to do whatever they see fit.

It suddenly becomes crystal clear why the Oakland public were chanting "who are you protecting?" as the Oakland police force closed in to attack them for being in the streets of Oakland, threatening the use of "chemical agents" via a megaphone and throwing a flash grenade at those trying to help a wounded man:

The mainstream media have been clamouring for a list of demands, yet I and many others find it refreshing that none has yet been forthcoming.

I fear that setting demands is tantamount to saying "give us this much and then we will go home and allow the destruction that is business as usual to continue". For example, there is growing momentum behind calls for Occupy to demand a 'Robin Hood tax'. Yet as banks can and do create money it seems that demanding a fraction back might amount to selling ourselves for nothing.

The mainstream media have been clamouring for a list of demands, yet I and many others find it refreshing that none has yet been forthcoming.

I fear that setting demands is tantamount to saying "give us this much and then we will go home and allow the destruction that is business as usual to continue". For example, there is growing momentum behind calls for Occupy to demand a 'Robin Hood tax'. Yet as banks can and do create money it seems that demanding a fraction back might amount to selling ourselves for nothing.

Consequently, her absolute #1 piece of advice to all and sundry is to get out of debt, as debts that may seem manageable now are unlikely to remain so as interest rates soar and property prices plummet (perhaps back to somewhere in the region of their 1970 values). Meanwhile, existing mortgage debts will stubbornly remain just as large, leaving many people in the ordeal of negative equity - their mortgage debt being bigger than the value of their house.

She also explained the 'derivatives' market in a usefully clear way. Whereas many of the world's money-making schemes are based on cutting the proverbial cake into smaller and smaller slices, this system is based on giving more and more people rights over a single slice of cake. As this system unravels (as it surely must at some point, since not every claimant can have their cake to eat it), the bulk of the world's money will essentially disappear, creating huge deflation. There will be less money in circulation relative to the amount of stuff, so the value of the money that people do have will actually go up, while earnings drop. As she pointed out, the key issue to be concerned with is 'affordability' not inflation, deflation, wages or anything else. How much useful stuff can you buy with what you have?

While not explicit about it as such, she seemed to be ranking the kinds of assets we might hold in terms of risk. In order, starting with the most desirable, that list was:

Useful assets - e.g. tools, land, a home that you want to live in, and that can supply what you need etc...

Cash - as deflation is likely to raise the value of cash, it's a good thing to have, but cash in bank accounts is quite liable to evaporate. In response to the inevitable question of where we should keep cash, her repeated answer was "be creative".

Gilts - Given that holding massive amounts of cash is both impractical and likely to arouse suspicion, she suggested gilts as the next least-risky place to put money.

Interestingly though, she believes that while useful productive assets are the most important thing (these are, after all, the source of our ability to support our communities and ourselves), she also pointed out that the price of such assets is likely to drop as the crisis tightens.

Consequently, her absolute #1 piece of advice to all and sundry is to get out of debt, as debts that may seem manageable now are unlikely to remain so as interest rates soar and property prices plummet (perhaps back to somewhere in the region of their 1970 values). Meanwhile, existing mortgage debts will stubbornly remain just as large, leaving many people in the ordeal of negative equity - their mortgage debt being bigger than the value of their house.

She also explained the 'derivatives' market in a usefully clear way. Whereas many of the world's money-making schemes are based on cutting the proverbial cake into smaller and smaller slices, this system is based on giving more and more people rights over a single slice of cake. As this system unravels (as it surely must at some point, since not every claimant can have their cake to eat it), the bulk of the world's money will essentially disappear, creating huge deflation. There will be less money in circulation relative to the amount of stuff, so the value of the money that people do have will actually go up, while earnings drop. As she pointed out, the key issue to be concerned with is 'affordability' not inflation, deflation, wages or anything else. How much useful stuff can you buy with what you have?

While not explicit about it as such, she seemed to be ranking the kinds of assets we might hold in terms of risk. In order, starting with the most desirable, that list was:

Useful assets - e.g. tools, land, a home that you want to live in, and that can supply what you need etc...

Cash - as deflation is likely to raise the value of cash, it's a good thing to have, but cash in bank accounts is quite liable to evaporate. In response to the inevitable question of where we should keep cash, her repeated answer was "be creative".

Gilts - Given that holding massive amounts of cash is both impractical and likely to arouse suspicion, she suggested gilts as the next least-risky place to put money.

Interestingly though, she believes that while useful productive assets are the most important thing (these are, after all, the source of our ability to support our communities and ourselves), she also pointed out that the price of such assets is likely to drop as the crisis tightens.

Accordingly, she counselled that one possible course of action for those unable to afford the productive assets they need (land, say) without going into debt, could be to minimise their exposure to the crash, preserve any cash that they can, and then buy more cheaply further down the slope. Those who can afford to buy outright now though, would be well-advised to do so, as while their assets, land etc. may decrease in value, this is of less significance if they plan to hold on to these assets long-term anyway, and in return they are buying themselves time to learn to use these 'tools', before they are relying on them.

As she spoke, the room was hushed and fiercely attentive, and you could see people absorbing the implications of what she said for their own financial plans, and those of their communities and families.

One very interesting question was from a Transitioner who is considering setting up a community-owned renewables project, based on taking out a loan to install PV, and paying back the loan on the basis of the Government's feed-in tariffs. Stoneleigh argued that in the current situation, any Government guarantee to do anything over the next 20-25 years is barely worth the paper it's written on, and so she would advise that such projects should be undertaken either without going into debt or not at all.

Above all, she stressed the urgency of the situation, and that we should not expect the financial situation to look at all like it does now in just a couple of years time.

Accordingly, she counselled that one possible course of action for those unable to afford the productive assets they need (land, say) without going into debt, could be to minimise their exposure to the crash, preserve any cash that they can, and then buy more cheaply further down the slope. Those who can afford to buy outright now though, would be well-advised to do so, as while their assets, land etc. may decrease in value, this is of less significance if they plan to hold on to these assets long-term anyway, and in return they are buying themselves time to learn to use these 'tools', before they are relying on them.

As she spoke, the room was hushed and fiercely attentive, and you could see people absorbing the implications of what she said for their own financial plans, and those of their communities and families.

One very interesting question was from a Transitioner who is considering setting up a community-owned renewables project, based on taking out a loan to install PV, and paying back the loan on the basis of the Government's feed-in tariffs. Stoneleigh argued that in the current situation, any Government guarantee to do anything over the next 20-25 years is barely worth the paper it's written on, and so she would advise that such projects should be undertaken either without going into debt or not at all.

Above all, she stressed the urgency of the situation, and that we should not expect the financial situation to look at all like it does now in just a couple of years time.

In my one-to-one chat with her on Friday night, I asked her about my Student Loan, which is currently about the most benign loan imaginable, with a rate of interest generally lower than that available on

In my one-to-one chat with her on Friday night, I asked her about my Student Loan, which is currently about the most benign loan imaginable, with a rate of interest generally lower than that available on

Shaun is a co-founder of Transition Town Kingston and the author of

Shaun is a co-founder of Transition Town Kingston and the author of

Recent Comments